HW 1¶

By: Chengyi (Jeff) Chen

%load_ext nb_black

%matplotlib inline

import matplotlib.pyplot as plt

plt.rcParams["figure.dpi"] = 300

plt.rcParams["figure.figsize"] = (16, 12)

import pandas as pd

import numpy as np

import cvxpy as cp

import scipy as sp

from collections import namedtuple

from statsmodels.graphics.gofplots import qqplot

from datetime import datetime, timedelta

from tqdm import tqdm

/opt/anaconda3/envs/ml/lib/python3.7/site-packages/statsmodels/tools/_testing.py:19: FutureWarning: pandas.util.testing is deprecated. Use the functions in the public API at pandas.testing instead.

import pandas.util.testing as tm

data = pd.read_excel(

"./data/HW1_Due20200927.xlsx", sheet_name="DataSource", header=[0, 1]

).dropna(how="all", axis=1)

vix = data["VIX Index"]

vix = vix.set_index("Date")

vix.index = pd.to_datetime(vix.index)

vix.head()

| Price | |

|---|---|

| Date | |

| 1999-01-15 | 29.24 |

| 1999-01-19 | 29.24 |

| 1999-01-20 | 28.60 |

| 1999-01-21 | 30.92 |

| 1999-01-22 | 31.95 |

spy = data["SPY ETF"]

spy = spy.set_index("Dates")

spy.index = pd.to_datetime(spy.index)

spy.head()

| Price | |

|---|---|

| Dates | |

| 1999-01-15 | 124.3750 |

| 1999-01-19 | 125.1875 |

| 1999-01-20 | 126.1875 |

| 1999-01-21 | 122.8438 |

| 1999-01-22 | 122.5625 |

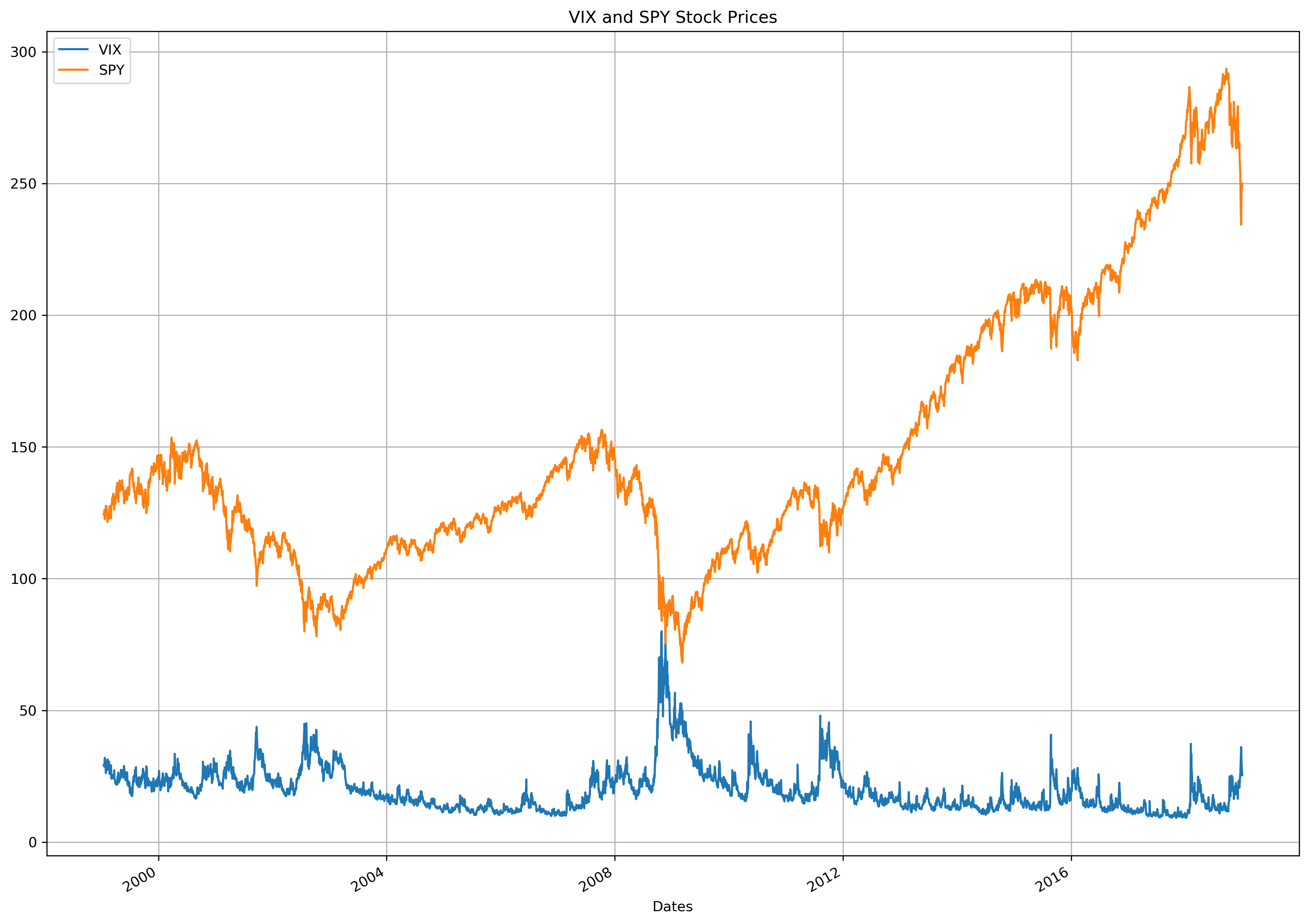

fig, ax = plt.subplots(1, 1)

vix.rename({"Price": "VIX"}, axis=1).plot.line(ax=ax)

spy.rename({"Price": "SPY"}, axis=1).plot.line(ax=ax)

plt.title("VIX and SPY Stock Prices")

plt.legend()

plt.grid(True)

plt.show()

Problem 1¶

Data: the VIX price time series on the tab DataSource

1. Transform VIX daily price time series to daily return time series¶

vix_returns = vix.pct_change(1).iloc[1:]

vix_returns = vix_returns.rename({"Price": "daily_returns"}, axis=1)

vix_returns.head()

| daily_returns | |

|---|---|

| Date | |

| 1999-01-19 | 0.000000 |

| 1999-01-20 | -0.021888 |

| 1999-01-21 | 0.081119 |

| 1999-01-22 | 0.033312 |

| 1999-01-25 | -0.025665 |

spy_returns = spy.pct_change(1).iloc[1:]

spy_returns = spy_returns.rename({"Price": "daily_returns"}, axis=1)

spy_returns.head()

| daily_returns | |

|---|---|

| Dates | |

| 1999-01-19 | 0.006533 |

| 1999-01-20 | 0.007988 |

| 1999-01-21 | -0.026498 |

| 1999-01-22 | -0.002290 |

| 1999-01-25 | 0.010199 |

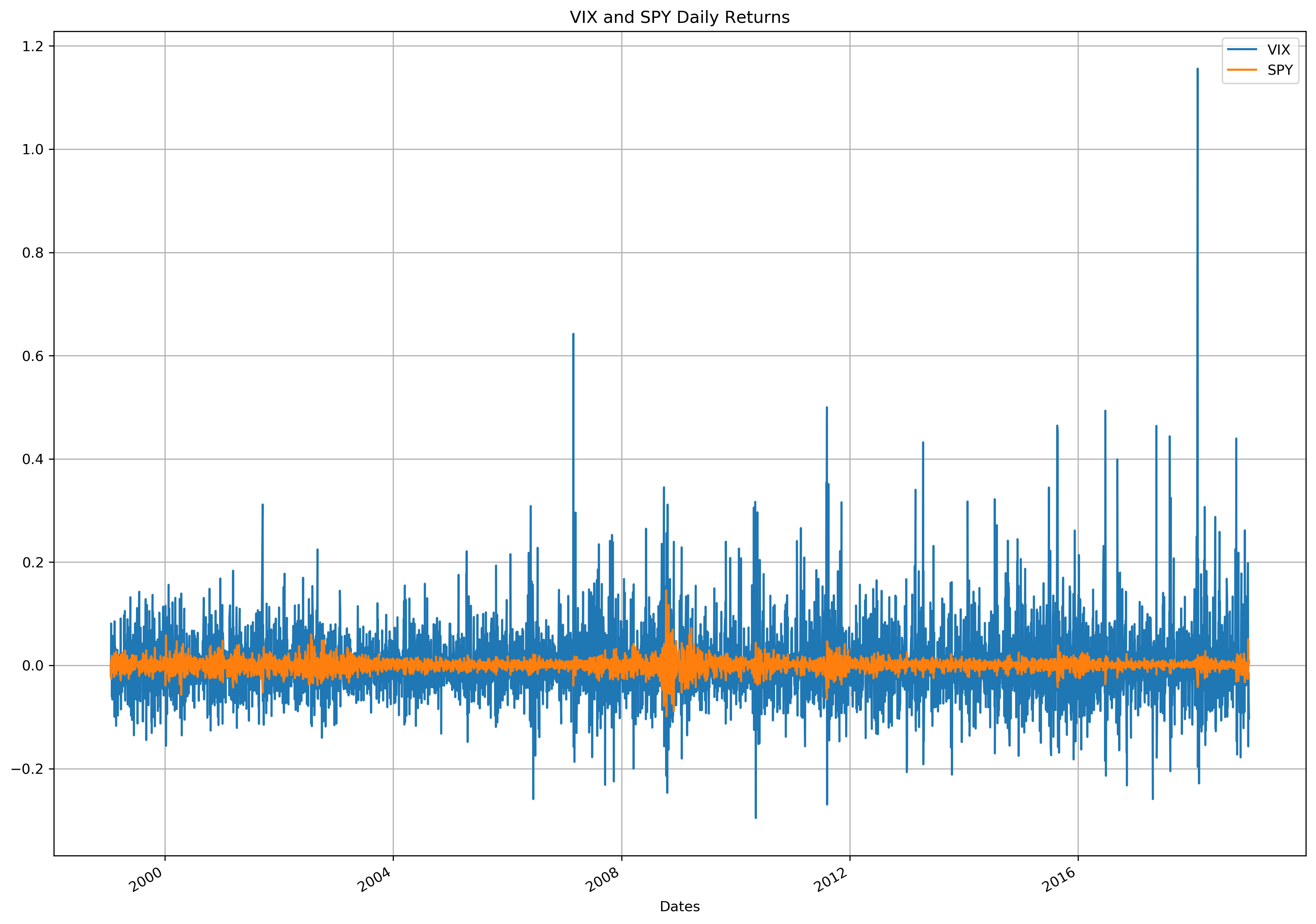

fig, ax = plt.subplots(1, 1)

vix_returns.rename({"daily_returns": "VIX"}, axis=1).plot.line(ax=ax)

spy_returns.rename({"daily_returns": "SPY"}, axis=1).plot.line(ax=ax)

plt.title("VIX and SPY Daily Returns")

plt.legend()

plt.grid(True)

plt.show()

2. Calculate the sample moments (mean,skewness, and kurtosis) for the VIX daily returns¶

vix_returns.mean()

daily_returns 0.002357

dtype: float64

vix_returns.skew()

daily_returns 2.014783

dtype: float64

vix_returns.kurtosis()

daily_returns 19.302523

dtype: float64

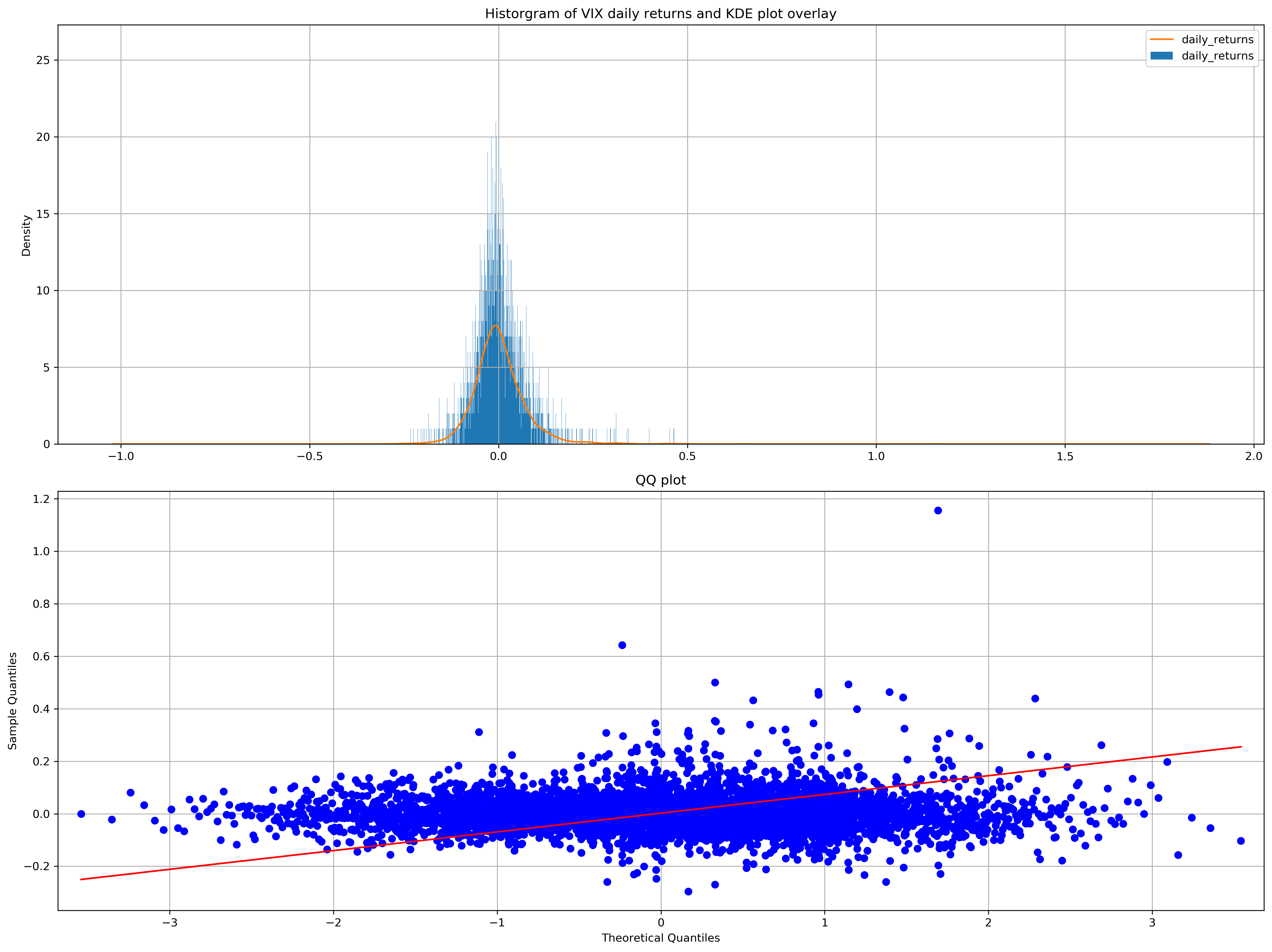

3. Test whether the VIX daily returns were normally distributed or not. (Need to generate necessary figures and statistics for normality test, describe your observations before make any conclusion)¶

fig, ax = plt.subplots(2, 1)

vix_returns.plot.hist(bins=5000, ax=ax[0])

vix_returns.plot.kde(ax=ax[0])

ax[0].set_title("Historgram of VIX daily returns and KDE plot overlay")

ax[0].grid(True)

qqplot(vix_returns, line="s", ax=ax[1])

ax[1].set_title("QQ plot")

ax[1].grid(True)

plt.tight_layout()

plt.show()

Although visually, the histogram and kernel density estimation makes the VIX daily returns look normally distributed, let’s use a statistical test to verify.

Shapiro-Wilk Test¶

α = 0.05

sw_stat, p_val = sp.stats.shapiro(vix_returns)

print(f"H_0: Vix is drawn from a Normal Distribution")

print(f"H_α: Vix is not from a Normal Distribution")

print(

f"Failed to reject H_0 as p-value ({p_val}) @ {α*100}% significance level"

if p_val > α

else f"H_0 is rejected as p-value ({p_val}) @ {α*100}% significance level"

)

H_0: Vix is drawn from a Normal Distribution

H_α: Vix is not from a Normal Distribution

H_0 is rejected as p-value (0.0) @ 5.0% significance level

/opt/anaconda3/envs/ml/lib/python3.7/site-packages/scipy/stats/morestats.py:1681: UserWarning: p-value may not be accurate for N > 5000.

warnings.warn("p-value may not be accurate for N > 5000.")

D’Agostino’s \(K^2\) Test¶

α = 0.05

sw_stat, p_val = sp.stats.normaltest(vix_returns)

print(f"H_0: Vix is drawn from a Normal Distribution")

print(f"H_α: Vix is not from a Normal Distribution")

print(

f"Failed to reject H_0 as p-value ({p_val}) @ {α*100}% significance level"

if p_val > α

else f"H_0 is rejected as p-value ({p_val}) @ {α*100}% significance level"

)

H_0: Vix is drawn from a Normal Distribution

H_α: Vix is not from a Normal Distribution

H_0 is rejected as p-value ([0.]) @ 5.0% significance level

Kolmogorov-Smirnov Test¶

α = 0.05

ks_stat, p_val = sp.stats.kstest(rvs=vix_returns, cdf="norm")

print(f"H_0: Vix is drawn from a Normal Distribution")

print(f"H_α: Vix is not from a Normal Distribution")

print(

f"Failed to reject H_0 as p-value ({p_val}) @ {α*100}% significance level"

if p_val > α

else f"H_0 is rejected as p-value ({p_val}) @ {α*100}% significance level"

)

H_0: Vix is drawn from a Normal Distribution

H_α: Vix is not from a Normal Distribution

H_0 is rejected as p-value (0.0) @ 5.0% significance level

All 3 tests reveal that though visually, the VIX daily returns look normally distributed, they are not.

Problem 2¶

Data: the SPY ETF price times series on the tab DataSource.

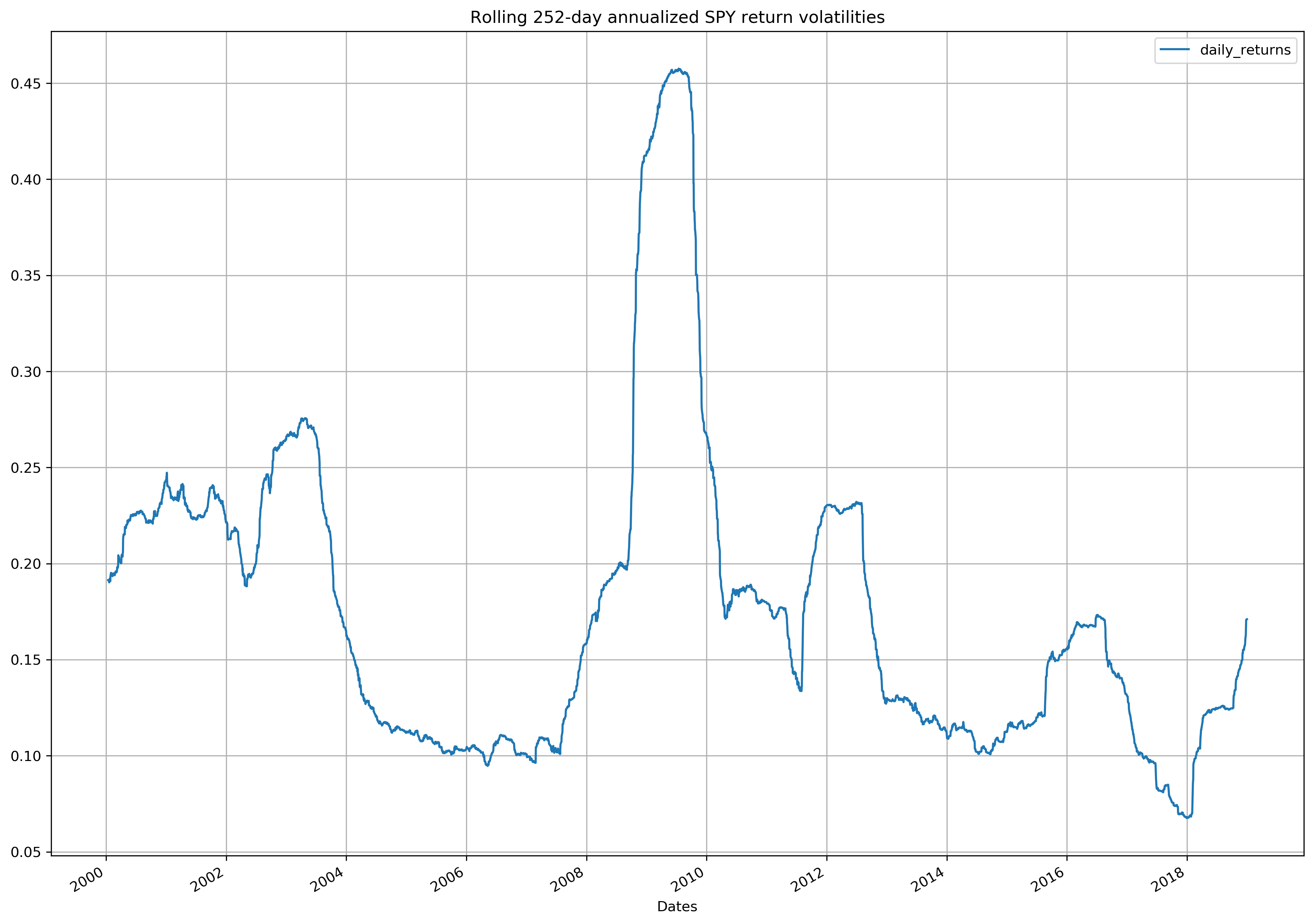

1. Calculate rolling 252-day annualized SPY return volatilities, and plot the time series¶

spy_returns.rolling(window=252).agg(

lambda daily_returns: (252 ** 0.5) * daily_returns.std()

).iloc[252 - 1 :].plot.line()

plt.title("Rolling 252-day annualized SPY return volatilities")

plt.grid(True)

plt.show()

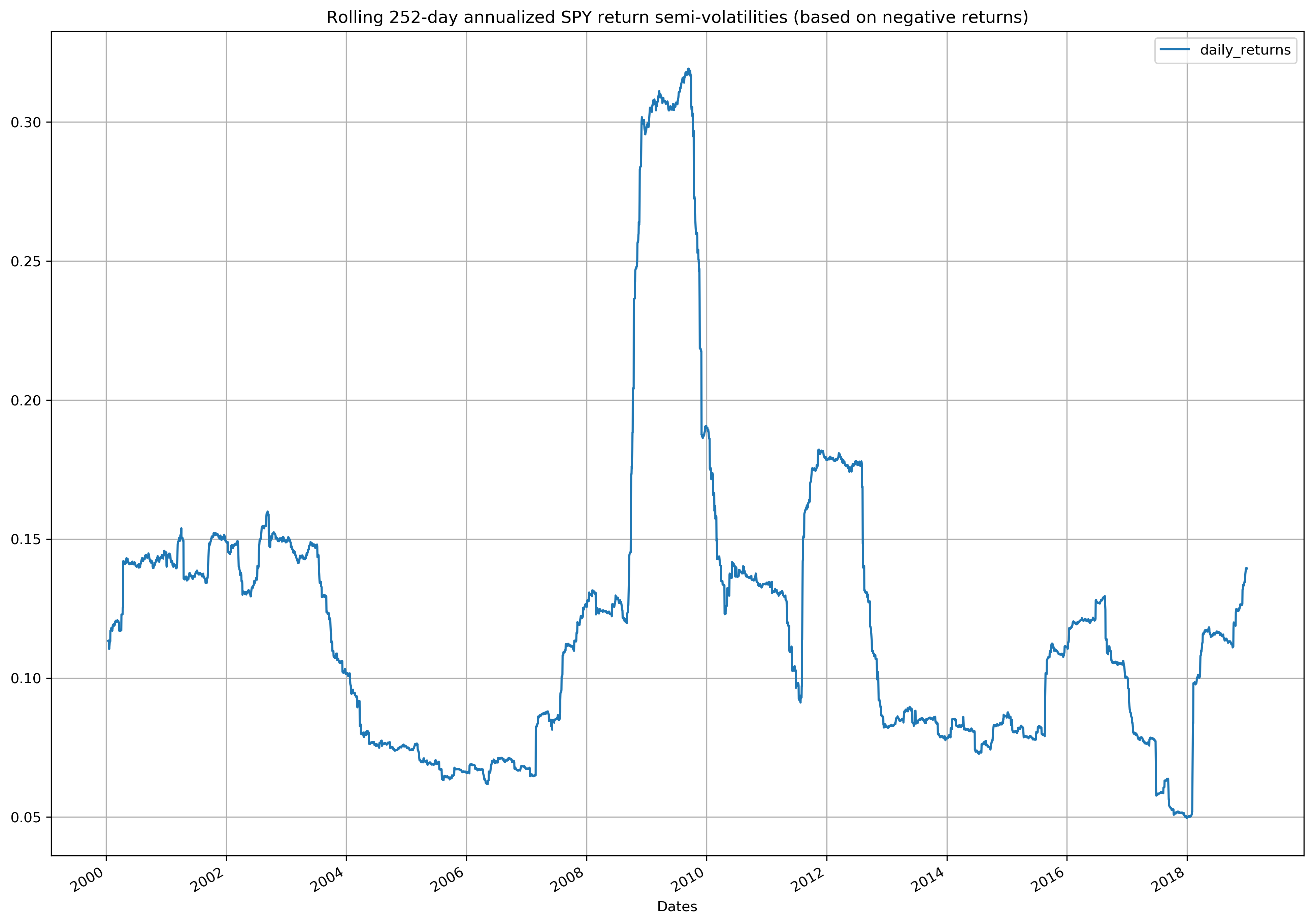

2. Calculate rolling 252-day annualized SPY return semi-volatility (based on negative daily returns) , and plot the time series¶

spy_returns.rolling(window=252).agg(

lambda daily_returns: (252 ** 0.5) * daily_returns[daily_returns < 0].std()

).iloc[252 - 1 :].plot.line()

plt.title(

"Rolling 252-day annualized SPY return semi-volatilities (based on negative returns)"

)

plt.grid(True)

plt.show()

3. Based on SPY daily returns in 2018, A). calculate its shortfall probability for a daily return less than -2%; B). Value at Risk at 95% for daily return; C). CVaR-95% for daily return.¶

print(

f"A) Shortfall Probaility for Daily Return < -2%: {np.round((spy_returns.loc['2018'] < -0.02).mean().values[0], 2)}"

)

print(

f"B) Value at Risk at 95% for daily return: {np.round(spy_returns.loc['2018'].quantile(q=0.05).values[0]*100, 2)}%"

)

print(

f"B) Value at Risk at 95% for daily return (Parametric): {np.round(sp.stats.norm.ppf(0.05, spy_returns.loc['2018'].mean(), spy_returns.loc['2018'].std())[0]*100, 2)}%"

)

print(

f"C) CVaR-95% for daily return: {np.round(spy_returns.loc['2018'][spy_returns.loc['2018'] <= spy_returns.loc['2018'].quantile(q=0.05)].mean().values[0]*100, 2)}%"

)

A) Shortfall Probaility for Daily Return < -2%: 0.06

B) Value at Risk at 95% for daily return: -2.14%

B) Value at Risk at 95% for daily return (Parametric): -1.8%

C) CVaR-95% for daily return: -2.79%

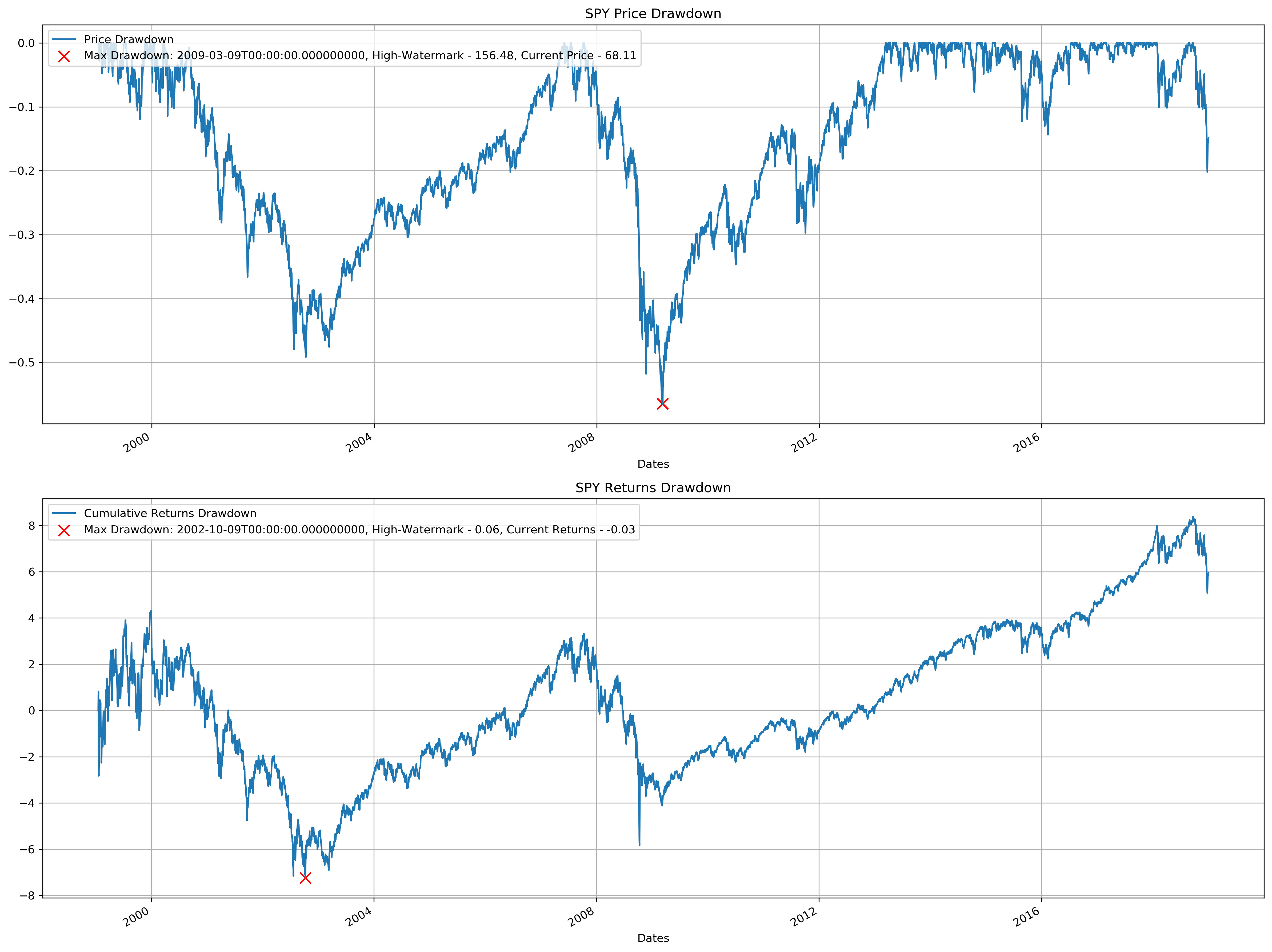

4. Calculate drawdowns for the SPY price times series, plot the drawdown time series, and locate the maximum drawdown for the whole period¶

fig, ax = plt.subplots(2, 1)

# Current SPY price / Largest SPY Price seen so far

spy_price_highwatermark = np.maximum.accumulate(spy)

spy_price_drawdown = (spy / spy_price_highwatermark - 1).rename(

{"Price": "Price Drawdown"}, axis=1

)

spy_price_drawdown.plot.line(ax=ax[0])

ax[0].scatter(

spy_price_drawdown.idxmin(),

spy_price_drawdown.min(),

s=100,

c="red",

marker="x",

label=f"Max Drawdown: {spy_price_drawdown.idxmin().values[0]}, High-Watermark - {np.round(spy_price_highwatermark.loc[spy_price_drawdown.idxmin()].values[0][0], 2)}, Current Price - {np.round(spy.loc[spy_price_drawdown.idxmin()].values[0][0], 2)}",

)

ax[0].set_title("SPY Price Drawdown")

ax[0].legend(loc=2)

ax[0].grid(True)

# Current Cum. returns / Largest Cum. returns so far

spy_returns_highwatermark = np.maximum.accumulate(spy_returns)

spy_cumreturns = np.cumprod(1 + spy_returns) - 1

spy_returns_drawdown = (spy_cumreturns / spy_returns_highwatermark) - 1

spy_returns_drawdown = spy_returns_drawdown.rename(

{"daily_returns": "Cumulative Returns Drawdown"}, axis=1

)

spy_returns_drawdown.plot.line(ax=ax[1])

ax[1].scatter(

spy_returns_drawdown.idxmin(),

spy_returns_drawdown.min(),

s=100,

c="red",

marker="x",

label=f"Max Drawdown: {spy_returns_drawdown.idxmin().values[0]}, High-Watermark - {np.round(spy_returns_highwatermark.loc[spy_returns_drawdown.idxmin()].values[0][0], 2)}, Current Returns - {np.round(spy_returns.loc[spy_returns_drawdown.idxmin()].values[0][0], 2)}",

)

ax[1].set_title("SPY Returns Drawdown")

ax[1].legend(loc=2)

ax[1].grid(True)

plt.tight_layout()

plt.show()

Problem 3¶

Data: Multi-Asset Class Monthly Returns on Datasource_CAPMAssetClasses

Assumptions:

No risk-free asset in the investable universe and all the risky assets are given on Datasource_CAPMAssetClasses;

Use historical covariance matrix and historical returns to estimate covariance matrix and expected return vector (see on lecture 2 notes)

No short-sell allowed. (before we have no such constraint)

data = pd.read_excel(

"./data/HW1_Due20200927.xlsx", sheet_name="DataSource_CAPMAssetClasses", header=[1],

).dropna(

how="all", axis=1

) # I'm assuming all of the values here are monthly returns in percentage

data = data.rename({"Period Ending": "Date"}, axis=1).set_index("Date") / 100

data.head()

| Bloomberg Barclays - U.S. TIPS Index | Bloomberg Barclays - U.S. Aggregate Index | BofA Merrill Lynch - U.S. High Yield Index | FTSE - Non U.S. Govt Bond Index ($) | Russell - 1000 Growth Index | Russell - 1000 Value Index | Russell - 2000 Growth Index | Russell - 2000 Value Index | MSCI - EAFE Index ($Net) | MSCI - Emerging Markets Index ($ Net) | S&P - GSCI Total Index | MSCI - U.S. REIT Index | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 1999-01-31 | 0.011644 | 0.0071 | 0.0135 | -0.0157 | 0.0587 | 0.0080 | 0.0450 | -0.0227 | -0.0030 | -0.015075 | 0.0044 | -0.026855 |

| 1999-02-28 | -0.006987 | -0.0175 | -0.0068 | -0.0351 | -0.0457 | -0.0141 | -0.0915 | -0.0683 | -0.0238 | 0.009635 | -0.0460 | -0.016449 |

| 1999-03-31 | -0.000145 | 0.0055 | 0.0116 | 0.0019 | 0.0527 | 0.0207 | 0.0356 | -0.0082 | 0.0417 | 0.132146 | 0.1688 | -0.005460 |

| 1999-04-30 | 0.006619 | 0.0032 | 0.0183 | -0.0015 | 0.0013 | 0.0934 | 0.0883 | 0.0913 | 0.0405 | 0.123700 | 0.0413 | 0.096692 |

| 1999-05-31 | 0.006887 | -0.0088 | -0.0092 | -0.0202 | -0.0307 | -0.0110 | 0.0016 | 0.0307 | -0.0515 | -0.005800 | -0.0546 | 0.021194 |

Expected Annualized Returns & Covariance Matrix¶

μ = (data + 1).prod() ** (12 / data.notnull().sum()) - 1 # Annualized Returns

Σ = data.cov() * 12 # Annualized Covariance matrix

1. Run an optimization to locate the minimum-variance portfolio on the new frontier.¶

w_minvar = cp.Variable((len(data.columns),), integer=False)

constraints = [

w_minvar.T @ np.ones((w_minvar.shape[0],)) == 1,

w_minvar >= 0, # No short-selling allowed

]

# Form objective.

obj = cp.Minimize(cp.quad_form(w_minvar, Σ))

# Form and solve problem.

prob = cp.Problem(obj, constraints)

prob.solve()

print("Quadratic Programming Solution")

print("=" * 30)

print(f"Status: {prob.status}")

print(f"Variance of Minimum-Variance Portfolio: {np.round(prob.value, 5)}")

print(

f"Expected Annualized Return of Minimum-Variance Portfolio: {np.round(w_minvar.value.T@μ, 5)}"

)

print("The optimal portfolio weights:")

print(

"\t"

+ "\n\t".join(

[

security + ": " + str(np.abs(np.round(w_minvar_i, 2)))

for security, w_minvar_i in zip(data.columns, w_minvar.value)

]

)

)

Quadratic Programming Solution

==============================

Status: optimal

Variance of Minimum-Variance Portfolio: 0.00103

Expected Annualized Return of Minimum-Variance Portfolio: 0.04577

The optimal portfolio weights:

Bloomberg Barclays - U.S. TIPS Index: 0.0

Bloomberg Barclays - U.S. Aggregate Index: 0.93

BofA Merrill Lynch - U.S. High Yield Index: 0.0

FTSE - Non U.S. Govt Bond Index ($): 0.0

Russell - 1000 Growth Index: 0.01

Russell - 1000 Value Index: 0.04

Russell - 2000 Growth Index: 0.01

Russell - 2000 Value Index: 0.0

MSCI - EAFE Index ($Net): 0.0

MSCI - Emerging Markets Index ($ Net): 0.0

S&P - GSCI Total Index: 0.01

MSCI - U.S. REIT Index: 0.0

2A. Run optimizations to locate two other efficient portfolios different than the minimum-variance portfolio¶

1. Risk-level Upperbound \(σ \leq 0.05\)¶

σ_1 = 0.05

w_σ_1 = cp.Variable((len(data.columns),), integer=False)

constraints = [

cp.quad_form(w_σ_1, Σ) <= σ_1 ** 2,

w_σ_1.T @ np.ones((w_σ_1.shape[0],)) == 1,

w_σ_1 >= 0, # No short-selling allowed

]

# Form objective.

obj = cp.Maximize(w_σ_1.T @ μ)

# Form and solve problem.

prob = cp.Problem(obj, constraints)

prob.solve()

print("Quadratic Programming Solution")

print("=" * 30)

print(f"Status: {prob.status}")

print(

f"Variance of Max Expected Return with σ <= {σ_1} Portfolio: {np.round(cp.quad_form(w_σ_1, Σ).value, 5)}"

)

print(

f"Expected Annualized Return of Max Expected Return with σ <= {σ_1} Portfolio: {np.round(prob.value, 5)}"

)

print("The optimal portfolio weights:")

print(

"\t"

+ "\n\t".join(

[

security + ": " + str(np.abs(np.round(w_σ_1_i, 2)))

for security, w_σ_1_i in zip(data.columns, w_σ_1.value)

]

)

)

Quadratic Programming Solution

==============================

Status: optimal

Variance of Max Expected Return with σ <= 0.05 Portfolio: 0.0025

Expected Annualized Return of Max Expected Return with σ <= 0.05 Portfolio: 0.05637

The optimal portfolio weights:

Bloomberg Barclays - U.S. TIPS Index: 0.27

Bloomberg Barclays - U.S. Aggregate Index: 0.43

BofA Merrill Lynch - U.S. High Yield Index: 0.14

FTSE - Non U.S. Govt Bond Index ($): 0.0

Russell - 1000 Growth Index: 0.0

Russell - 1000 Value Index: 0.0

Russell - 2000 Growth Index: 0.0

Russell - 2000 Value Index: 0.11

MSCI - EAFE Index ($Net): 0.0

MSCI - Emerging Markets Index ($ Net): 0.0

S&P - GSCI Total Index: 0.0

MSCI - U.S. REIT Index: 0.05

2. Risk-level Upperbound \(σ \leq 1.00\)¶

σ_2 = 1

w_σ_2 = cp.Variable((len(data.columns),), integer=False)

constraints = [

cp.quad_form(w_σ_2, Σ) <= σ_2 ** 2,

w_σ_2.T @ np.ones((w_σ_2.shape[0],)) == 1,

w_σ_2 >= 0, # No short-selling allowed

]

# Form objective.

obj = cp.Maximize(w_σ_2.T @ μ)

# Form and solve problem.

prob = cp.Problem(obj, constraints)

prob.solve()

print("Quadratic Programming Solution")

print("=" * 30)

print(f"Status: {prob.status}")

print(

f"Variance of Max Expected Return with σ <= {σ_2} Portfolio: {np.round(cp.quad_form(w_σ_2, Σ).value, 5)}"

)

print(

f"Expected Annualized Return of Max Expected Return with σ <= {σ_2} Portfolio: {np.round(prob.value, 5)}"

)

print("The optimal portfolio weights:")

print(

"\t"

+ "\n\t".join(

[

security + ": " + str(np.abs(np.round(w_σ_2_i, 2)))

for security, w_σ_2_i in zip(data.columns, w_σ_2.value)

]

)

)

Quadratic Programming Solution

==============================

Status: optimal

Variance of Max Expected Return with σ <= 1 Portfolio: 0.04336

Expected Annualized Return of Max Expected Return with σ <= 1 Portfolio: 0.09651

The optimal portfolio weights:

Bloomberg Barclays - U.S. TIPS Index: 0.0

Bloomberg Barclays - U.S. Aggregate Index: 0.0

BofA Merrill Lynch - U.S. High Yield Index: 0.0

FTSE - Non U.S. Govt Bond Index ($): 0.0

Russell - 1000 Growth Index: 0.0

Russell - 1000 Value Index: 0.0

Russell - 2000 Growth Index: 0.0

Russell - 2000 Value Index: 0.0

MSCI - EAFE Index ($Net): 0.0

MSCI - Emerging Markets Index ($ Net): 0.0

S&P - GSCI Total Index: 0.0

MSCI - U.S. REIT Index: 1.0

2B. Prove or disprove the minimum-variance portfolio can be represented as a combination of the two portfolios found on 2A.¶

x = cp.Variable((2,), integer=False)

constraints = [x.T @ np.ones((2,)) == 1, x >= 0]

# Form objective.

obj = cp.Minimize(

np.mean((((np.array([w_σ_1.value, w_σ_2.value])).T @ x) @ w_minvar.value) ** 2)

)

# Form and solve problem.

prob = cp.Problem(obj, constraints)

prob.solve()

2.016525880278835e-21

The minimum-variance portfolio cannot be represented as a combination of 2 portfolios as all 3 vectors are linearly independent.

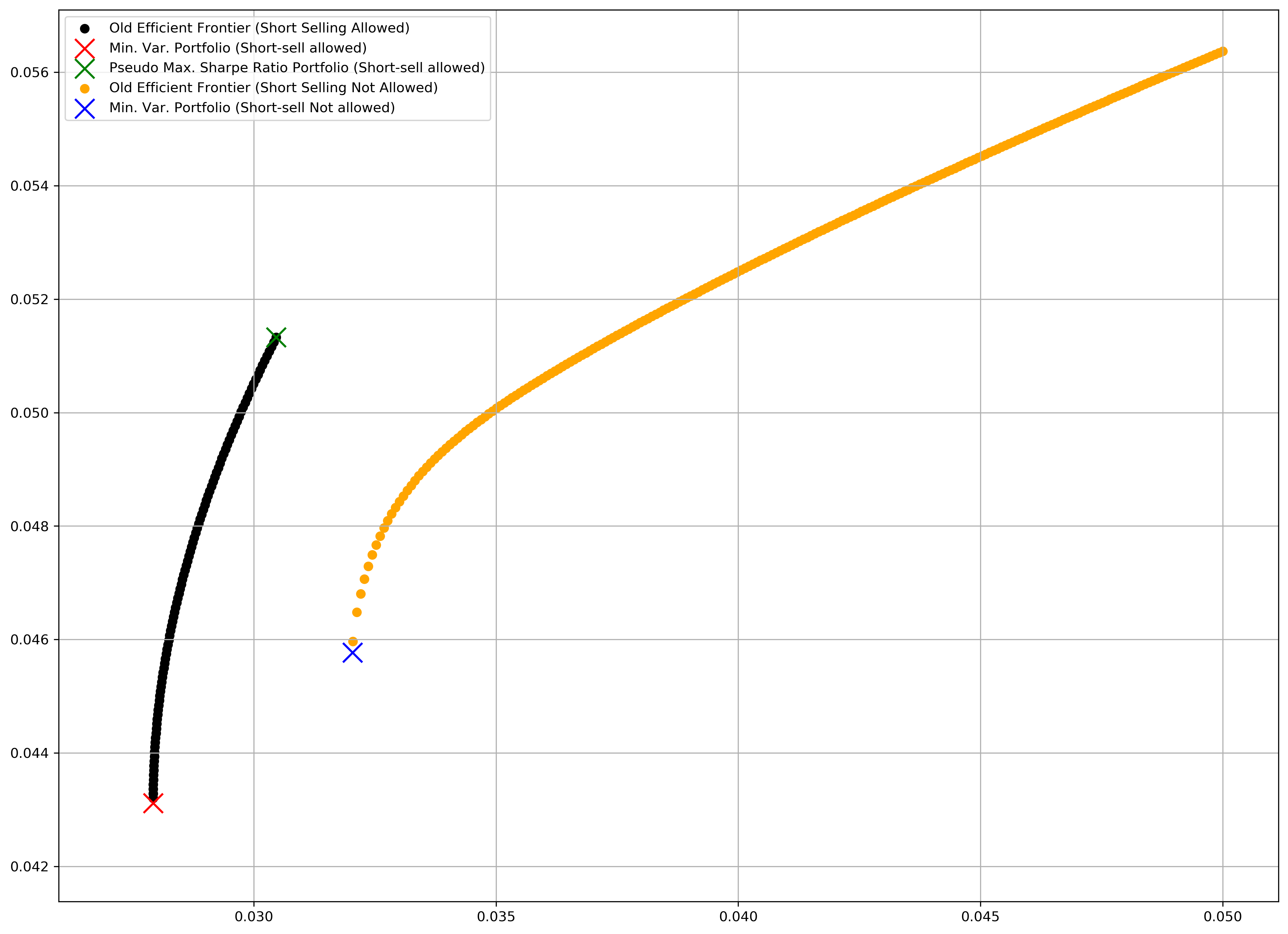

3. Plot both the old efficient frontier without the short-sell constraint and the new efficient frontier with the short-sell constraint on the same graph.¶

# Two -Fund Theorem

w_minvar_shortsell_allowed = (np.linalg.inv(Σ) @ np.ones((Σ.shape[0],))) / (

np.ones((Σ.shape[0],)).T @ np.linalg.inv(Σ) @ np.ones((Σ.shape[0],))

)

w_msr_shortsell_allowed = (np.linalg.inv(Σ) @ μ) / (

np.ones((Σ.shape[0],)).T @ np.linalg.inv(Σ) @ μ

)

w_2_fund_theorem_shortsell_allowed = lambda α: np.array([α, 1 - α]).T @ np.array(

[w_minvar_shortsell_allowed, w_msr_shortsell_allowed]

)

old_efficient_frontier = [

(

(

w_2_fund_theorem_shortsell_allowed(α).T

@ Σ

@ w_2_fund_theorem_shortsell_allowed(α)

)

** 0.5,

w_2_fund_theorem_shortsell_allowed(α).T @ μ,

)

for α in np.arange(0, 1, 0.01)

]

new_efficient_frontier = []

for σ in np.linspace(0.01, 0.05, 500):

w = cp.Variable((len(data.columns),), integer=False)

constraints = [

cp.quad_form(w, Σ) <= σ ** 2,

w.T @ np.ones((w.shape[0],)) == 1,

w >= 0, # No short-selling allowed

]

# Form objective.

obj = cp.Maximize(w.T @ μ)

# Form and solve problem.

prob = cp.Problem(obj, constraints)

prob.solve()

if prob.status == "optimal":

new_efficient_frontier.append((cp.quad_form(w, Σ).value ** 0.5, prob.value))

plt.scatter(

*list(zip(*old_efficient_frontier)),

c="black",

label="Old Efficient Frontier (Short Selling Allowed)"

)

plt.scatter(

(w_minvar_shortsell_allowed @ Σ @ w_minvar_shortsell_allowed) ** 0.5,

w_minvar_shortsell_allowed.T @ μ,

c="red",

marker="x",

s=200,

label="Min. Var. Portfolio (Short-sell allowed)",

)

plt.scatter(

(w_msr_shortsell_allowed @ Σ @ w_msr_shortsell_allowed) ** 0.5,

w_msr_shortsell_allowed.T @ μ,

c="green",

marker="x",

s=200,

label="Pseudo Max. Sharpe Ratio Portfolio (Short-sell allowed)",

)

plt.scatter(

*list(zip(*new_efficient_frontier)),

c="orange",

label="Old Efficient Frontier (Short Selling Not Allowed)"

)

plt.scatter(

(w_minvar.value.T @ Σ @ w_minvar.value) ** 0.5,

w_minvar.value.T @ μ,

c="blue",

marker="x",

s=200,

label="Min. Var. Portfolio (Short-sell Not allowed)",

)

# plt.scatter(

# (w_msr_shortsell_allowed @ Σ @ w_msr_shortsell_allowed) ** 0.5,

# w_msr_shortsell_allowed.T @ μ,

# c="green",

# marker="x",

# s=200,

# label="Pseudo Max. Sharpe Ratio Portfolio (Short-sell allowed)",

# )

plt.grid(True)

plt.legend()

plt.show()